Work Without Limits

Scroll down

Welcome to Work Without Limits!

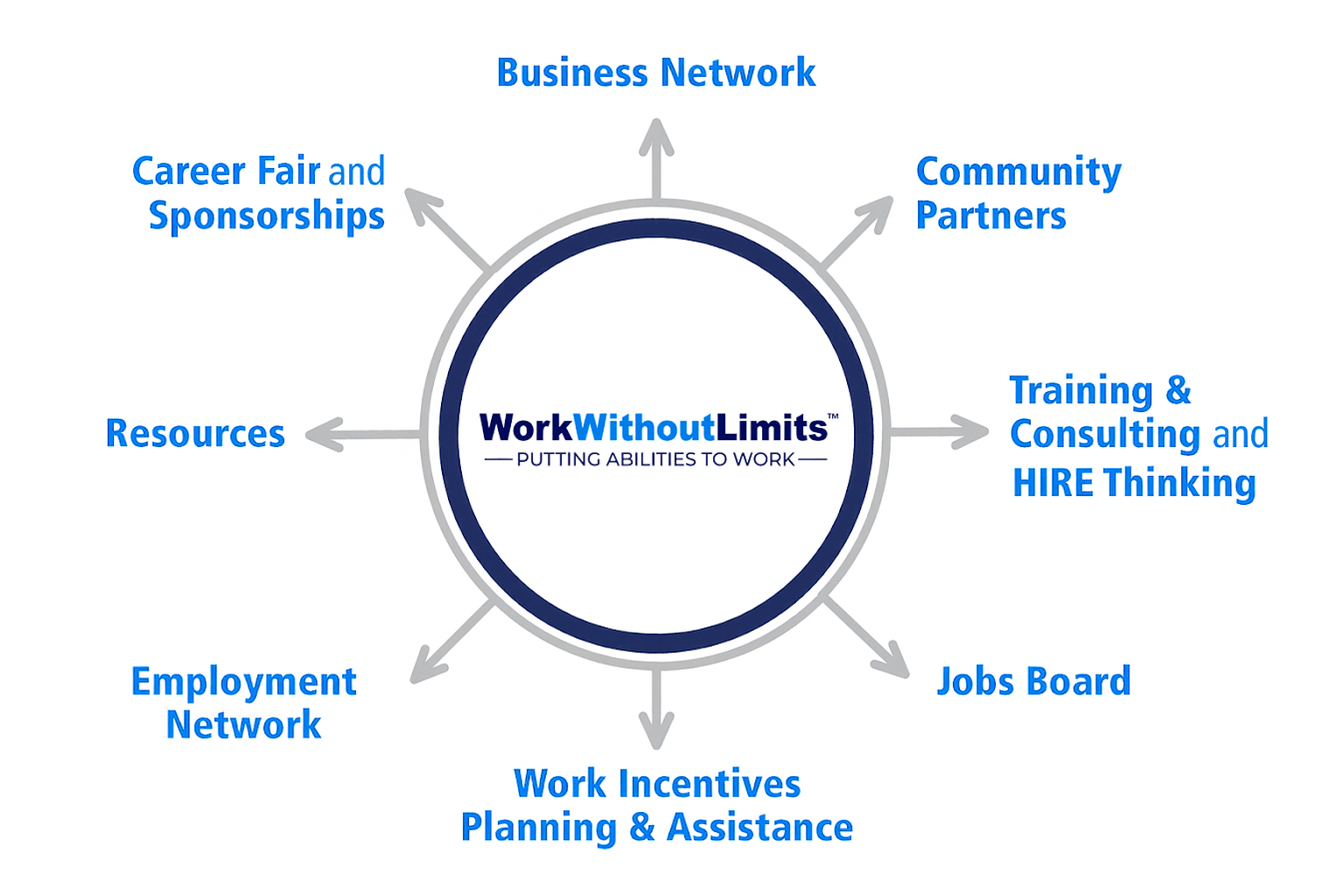

Work Without Limits is a network of employers, educational institutions, employment service providers, state and federal agencies, individuals with disabilities, and their family members. Through collaboration and partnership, our goal is to increase the employment of people with disabilities until it is equal to those without disabilities. Work Without Limits programs and services are geared to meet the needs of employers that actively recruit people with disabilities as employees and in their supply chains, individuals with disabilities who are seeking jobs, and the employment service providers that serve them.

See our FY25-Year-in-Review.pdf